idaho estate tax return

Call the toll-free automated refund information number. Object Moved This document may be found here.

4 Things You Need To Know About Inheritance And Estate Taxes

Subscribe to US Legal Forms and get access to numerous template.

. Understand typical refund time frames. The Estate Tax is a tax on your right to transfer property at your death. In the Boise area call 208 364-7389.

Nobody wants to hear from theIRS âand I mean nobody. Estate Tax Returns. Idaho Estate and Transfer Tax Return must immediately be filed along with a copy of the amended Federal Estate Tax Return.

Fiduciary - An automatic six-month extension of time to file is granted until 6 months after the original due date of the return. For first-time filers if you have received the message that your return is not in our system. File an estate tax return on Form 706 United States Estate and Generation-Skipping Transfer Tax Return.

Preparation of a state tax return for Idaho is available for 2995. Idaho does not impose or assess an estate tax even though the federal government does. An estate administrator must file the final tax return for a deceased person separate from their estate income tax return.

You can expect to receive your. Full-time Idaho residents who filed taxes in 2020 and 2021 will receive rebates equaling 10 of their 2020 income tax or 300 whichever is greater. The goal of this post will be to discuss certain Idaho estate gift and.

Payment of any additional tax due together. Direct Deposit is not available for Idaho. For paper filing it can take up to 10 weeks for your refund to complete processing.

The types of taxes a deceased taxpayers estate. Treasure Valley Concerned Over Rise in IRS Estate Tax Audits. You will also likely have to.

Idaho does not levy an inheritance tax or an estate tax. Include Form PTE-12 with. Estate tax is a tax on the transfer of assets.

Idaho State Tax Refund Status. Idaho Estate and Inheritance Tax Return Engagement Letter - 706 Are you looking for a printable document template. 13 April 2013 Author.

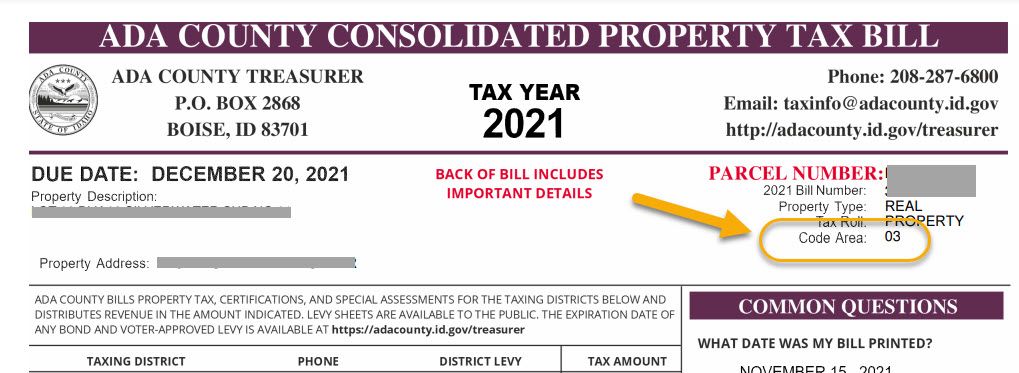

E-File is not available for Idaho. The tax is paid annually or semi-annually in December and June to your local county assessor. Keep in mind that if you inherit property from another state that state may have an estate tax that applies.

Joint filers will get 600. The final Idaho return for the trust or estate. It consists of an accounting of everything you own or have certain interests in at the date of death Refer to.

7 rows Idaho might require an Idaho individual income tax return Form 40 or Form 43 for the last. Line 5 Income Distribution Deduction Enter the amount of the deduction for distributions to beneficiaries. You can expect your refund about seven to eight weeks after you receive an acknowledgment that we have your return.

If the Idaho Fiduciary Income Tax Return Form 66 is filed within. The first 100000 of a businesss personal property is exempt from taxation.

/state-no-estate-tax-2000-654db88bef32439ab403da6132265b5a.jpg)

States With No Estate Or Inheritance Taxes

Where S My Refund Idaho H R Block

Legacy Home University Of Idaho

Idaho New Mexico And Wyoming Stand Out For Different Reasons In Analysis Of Tax Revenue Trends Boise State Public Radio

Historical Idaho Tax Policy Information Ballotpedia

Idaho Estate Tax Everything You Need To Know Smartasset

Maximize Your Tax Return Giving

Idaho Purchase And Sale Agreement Form Fill Out And Sign Printable Pdf Template Signnow

Idaho Gov Brad Little Extends Tax Filing Deadline To June 15 Idaho Statesman

Filing Final Tax Returns For The Deceased East Idaho Wealth Management

Complete Guide To Probate In Idaho

Old Idaho Penitentiary National Trust For Historic Preservation

Steve Miller S Idaho Estate Hitting Market For 16m Mansion Global

States With No Estate Tax Or Inheritance Tax Plan Where You Die

How To Start An Llc In Idaho For 49 Id Llc Registration Zenbusiness Inc

Company To Begin Mining Cobalt In Salmon River Mountains Idaho Statesman

10 Ways To Reduce Estate Taxes Findlaw

Idaho S Circuit Breaker Changes Will Disproportionately Affect Low Income Seniors Idaho Capital Sun